Table of Content

With floating rates, the interest rate of the home loan will change. If the repo rate increases, then both the interest rate and EMI will increase. Similarly, if the repo rate decreases, then the interest rate and EMI will also decrease. So, to calculate the EMI using SBI Home Loan EMI Calculator, check with the SBI bank to find the current interest rate.

Under the Credit Linked Subsidy Scheme of this Yojana, first-time and eligible borrowers can avail subsidies on their home loan interest rate. CreditMantri will never ask you to make a payment anywhere outside the secure CreditMantri website. DO NOT make payment to any other bank account or wallet or divulge your bank/card details to fraudsters and imposters claiming to be operating on our behalf. @modthepc, making the amortization schedule and deciding the percentage of interest and principal component is solely at the discretion of the bank. Hence I will not be able to help you with bank policy as that varies from bank to bank. As requested, I have mailed a copy the amortization chart to you, do have a look.

Document Information

But we maintain your records in our archives to readily serve you in the future. We never share your personal information with others unless required by law. This column simply indicates the serial number of each EMI with the details of each payment given in the respective rows. Use the Loanbaba EMI calculator on this page to understand the suitable tenure and EMI amount.

Currently, the lowest SBI Home Loan interest rate is 6.70 percent. Despite these challenges, refinancing can benefit borrowers, but they should weigh the comparison carefully and read any new agreement thoroughly. Submit the form along with a copy of documents, including PAN Card, Aadhaar Card, Passport, etc. Fill in all the necessary details such, as Home Loan Account Number, Applicant’s Date of Birth, Email ID and other contact details as applicable. You need to log in to Personal Banking for accessing and downloading the Home Loan statement.

Financial Calculators

Dishonouring a check / ECS / NACH is a criminal offence which can be subject to fines under the applicable provisions of the legislation. You may be listed as a defaulter for not paying the EMIs on time. If, despite repeated reminders, you refuse to regularise your payments, the Bank can legally reclaim your vehicle or property.

By clicking "Proceed" button, you will be redirected to the resources located on servers maintained and operated by third parties. SBI doesnt take any responsibility for the images, pictures, plan, layout, size, cost, materials shown in the site. You can opt to pay the interest component during the moratorium period to reduce the burden of EMI that commences after the course completion.

Privilege / Shaurya Home Loan Calculator

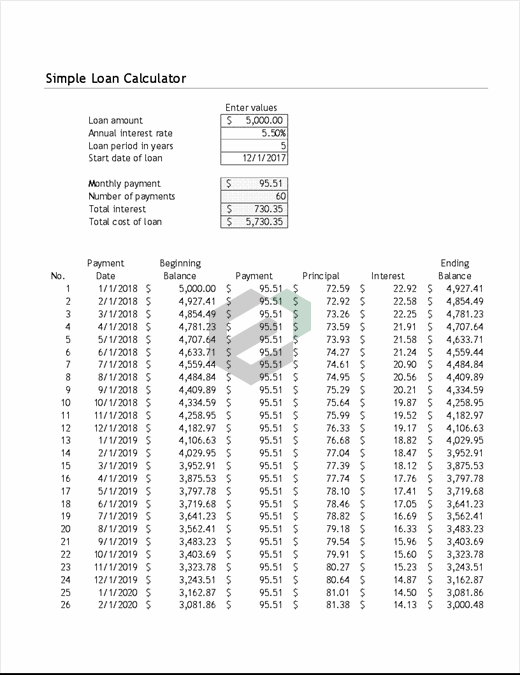

Note your monthly expenses, liabilities, and other financial obligations, including ongoing EMIs. Here we have illustrated the EMI on SBI home loan of Rs. 1 lakh @8.75% across different tenures. The amount of instalment every month is lower if you choose a longer tenure. Below given is the housing loan information by State Bank of India. This table can be used as a reference on how the EMI is calculated. Just this way, the borrower can apply for a home loan that seems to fit their budget after calculating different EMIs with the SBI Home Loan EMI Calculator.

This way, the borrower will be able to compare different EMIs. It can help with finding the loan amount and tenure with the lowest EMI. Prepayment penalties or lost mortgage interest deductions on tax returns are other examples of opportunity costs. Borrowers should consider such factors before making additional payments.

SBI Home Loan Details

The principal component can fluctuate from month to month, as shown, depending on the bank’s policy. This column indicates the rate of interest per annum and may keep varying at the discretion of your bank. This rate determines the EMI that you are required to pay every month.

I have mailed the amortization schedule to you, please have a look. Can you please share me the latest amortization schedule Excel sheet for 2015 . I wonder why the amount of principle deducted is not reflected in the statement. I have to indirectly calculate from the difference of drawing power of current and previous month.

The decision to change the loan tenure or the SBI Home Loan EMI Calculator EMI is for the borrower to choose in case of prepayment. If the loan has a fixed interest rate, then it will have the same EMI amount throughout the tenure. The only difference will be in the interest amount and principal repayment. With time, in the total EMI amount, the principal portion will increase, and the interest portion will decrease.

This table shows the exact amount of interest and principal that is deducted from your loan amount for each EMI you pay. Yes, you can withdraw the amount from your maxgain account any time. By parking money in your OD account, you will be reducing the book balance , by doing so, your total interest outgo will get reduced. However, each month, the principal repaid and interest payment proportion will be different in every EMI.

The below table of the first 12 payments will make this clear. Calculate the remaining tenure to pay the outstanding balance- the borrower can use the outstanding balance of the loan to know how long they will have to pay the EMI to clear the debt. If the tenure still seems long, try transferring the outstanding loan balance to a different bank that allows repayment at lower rates. The EMIs of an SBI Home Loan is the fixed amount that the borrower needs to pay monthly till the entire loan principal amount is repaid. Many factors determine the loan amount and the EMI amount is calculated mostly based on the tenure, loan amount, and interest rate. Privilege Home Loans is an exclusive home loan product for government employees whereas Shaurya Home Loan is for Defense Personals.

It also shows how fast the overall debt falls at a given time. EMIs – EMIs or Equated Monthly Instalments are the most common form of payment plans offered for any form of loan. In this form of repayment, the principal value of the debt plus the total interest is split into equivalent monthly payments for the term of the loan. This sum is called the EMI and is payable per month by the creditor on a set date.

You should choose tenure that you are comfortable with, keeping in mind the total payout every month. Loan tenure- this tenure is the period within which the borrower needs to pay back the loan amount. The longer the tenure of the loan, the lesser will be the EMI amount.

Please locate us and contact us for your home loan requirements. In India, most loan products offer the ‘EMI repayment’ method. This EMI amount is generally auto-debited from your bank account with the same bank or different bank. These days, a NACH mandate facilitates the auto deduction of the EMI amount from your bank account.

No comments:

Post a Comment